Abandoned baby bearish1

Bearish Advance block

Bearish belt hold

Bearish breakaway

Bearish doji star

Bearish engulfing

Bearish harami

Bearish harami cross

Bearish kicking

Bearish meeting lines

Bearish tri star

Belt hold bearish

Belt hold bullish

Black candle

Black marubozu

Breakaway bullish

Bullish abandoned baby

Bullish belt hold

Bullish breakaway

Bullish doji star

Bullish Engulfing

Bullish harami

Bullish harami cross

Bullish kicking

Bullish meeting lines

Bullish separating lines

Bullish tri star

Busted patterns

Candle black

Candle short black

Candle short white

Candle white

Chart patterns

Closing black marubozu

Closing white marubozu

Collapsing doji star

Evening star

Event patterns

Hanging man

In neck

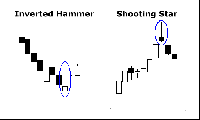

Inverted hammer 2 line 1

Kicking bearish

Kicking bullish

Ladder bottom

Last engulfing bottom

Last engulfing top

Long day black

Marubozu closing white

Marubozu opening black

Marubozu opening white

Rising window

Separating lines bearish

Separating lines bullish

.gif)

Shooting star (1 line)

Side by side white lines bearish

Three black crows

Three stars in the south

Three white soldiers

Thrusting

Tri star bullish

Upside Tasuki gap

White candle

White long day

Rising Three Methods

Piercing Line

Long Legged Doji

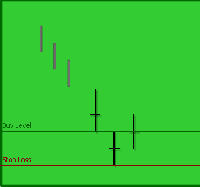

BEARISH LADDER TOP

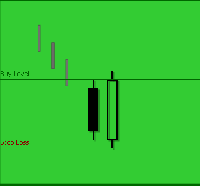

BULLISH STOP LOSS

BEARISH EVENING STAR

Above the Stomach

BULLISH HAMMER

BULLISH INVERTED HAMMER

BULLISH PIERCING LINE

BULLISH HOMING PIGEON

BULLISH MATCHING LOW

BULLISH ONE WHITE SOLDIER

BULLISH MORNING STAR

BULLISH MORNING DOJI STAR

BULLISH DOWNSIDE GAP TWO RABBITS

BULLISH UNIQUE THREE RIVER BOTTOM

BULLISH THREE WHITE SOLDIERS

BULLISH DESCENT BLOCK

BULLISH DELIBERATION BLOCK

BULLISH TWO RABBITS

BULLISH THREE INSIDE UP

BULLISH THREE OUTSIDE UP