Candle Sticks

Candlesticks are graphical representations of price fluctuations for currency pairs.

41. In neck

A doji line that develops when the Doji is at or very near the low of the day.

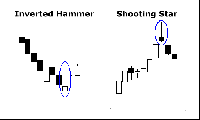

42. Inverted hammer 2 line 1

Hammer candlesticks form when a security moves significantly lower after the open but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during a decline then it is called a Hammer

43. Kicking bearish

A one day bullish reversal pattern. In a downtrend the open is lower then it trades higher but closes near its open therefore looking like an inverted lollipop.

44. Kicking bullish

Hanging Man candlesticks form when a security moves significantly lower after the open but rallies to close well above the intraday low. The resulting candlestick looks like a square lollipop with a long stick. If this candlestick forms during an advance then it is called a Hanging Man.

45. Ladder bottom

Definition

This pattern consists of a white body and a small black body that is completely inside the range of the white body. If an outline is drawn for the pattern it looks like a pregnant woman. This is not a coincidence.

This pattern consists of a white body and a small black body that is completely inside the range of the white body. If an outline is drawn for the pattern it looks like a pregnant woman. This is not a coincidence.

46. Last engulfing bottom

Definition

This pattern consists of a black body and a small white body that is completely inside the range of the black body. If an outline is drawn for the pattern it looks like a pregnant woman. This is not a coincidence.

This pattern consists of a black body and a small white body that is completely inside the range of the black body. If an outline is drawn for the pattern it looks like a pregnant woman. This is not a coincidence.

47. Last engulfing top

Definition

This is a major bearish reversal pattern which is even more significant than a regular Bearish Harami. The outline again looks like a pregnant woman as with the Bearish Harami Pattern. However now the baby is a Doji. Basically the pattern is characterized by a white body followed by a Doji that is completely inside the range of the prior white body.

Recognition Criteria

1. The market is characterized by a prevailing uptrend.

2. A white body is observed on the first day.

3. The Doji that is formed on the second day is completely engulfed by the body of the first day.

Pattern Requirements and Flexibility

The Bearish Harami Cross consists of two candlesticks in which the body of the first white candlestick engulfs the body of the following Doji. The body of the first candlestick may be short.

Trader

This is a major bearish reversal pattern which is even more significant than a regular Bearish Harami. The outline again looks like a pregnant woman as with the Bearish Harami Pattern. However now the baby is a Doji. Basically the pattern is characterized by a white body followed by a Doji that is completely inside the range of the prior white body.

Recognition Criteria

1. The market is characterized by a prevailing uptrend.

2. A white body is observed on the first day.

3. The Doji that is formed on the second day is completely engulfed by the body of the first day.

Pattern Requirements and Flexibility

The Bearish Harami Cross consists of two candlesticks in which the body of the first white candlestick engulfs the body of the following Doji. The body of the first candlestick may be short.

Trader

48. Long day black

Definition

This is a major bullish reversal pattern which is even more significant than a regular Bullish Harami. The outline again looks like a pregnant woman as with the Bullish Harami Pattern. However now the baby is a Doji. Basically the pattern is characterized by a black body followed by a Doji that is completely inside the range of the prior black body. Recognition Criteria

1. The market is characterized by a prevailing downtrend.

2. A black body is observed on the first day.

3. The Doji that is formed on the second day is completely engulfed by the body of the first day.

Pattern Requirements and Flexibility

The Bullish Harami Cross consists of two candlesticks in which the body of the first black candlestick engulfs the body of the following Doji. The body of the first candlestick may be short.

Trader

This is a major bullish reversal pattern which is even more significant than a regular Bullish Harami. The outline again looks like a pregnant woman as with the Bullish Harami Pattern. However now the baby is a Doji. Basically the pattern is characterized by a black body followed by a Doji that is completely inside the range of the prior black body. Recognition Criteria

1. The market is characterized by a prevailing downtrend.

2. A black body is observed on the first day.

3. The Doji that is formed on the second day is completely engulfed by the body of the first day.

Pattern Requirements and Flexibility

The Bullish Harami Cross consists of two candlesticks in which the body of the first black candlestick engulfs the body of the following Doji. The body of the first candlestick may be short.

Trader

49. Marubozu closing white

A one day bullish reversal pattern. In a downtrend the open is lower then it trades higher but closes near its open therefore looking like an inverted lollipop.

50. Marubozu opening black

Definition

This pattern consists firstly of a white Marubozu and then a black Marubozu. After the white Marubozu the market opens below the prior session

This pattern consists firstly of a white Marubozu and then a black Marubozu. After the white Marubozu the market opens below the prior session